Table of Contents

Every Solana wallet hides unclaimed SOL – small rent deposits stuck inside old token accounts from test mints, rugs or forgotten airdrops. A few specialized tools promise to help you recover that money. The three most used are Sol Incinerator, Claim Your SOL, and Unclaimed SOL.

All three have the same goal: help you claim SOL from inactive accounts or low valued tokens. But how they do it – and how much you actually get back – is where things change.

What These Tools Actually Do

Each SPL token account locks a small amount of SOL as rent. When that account is closed, the rent goes back to your wallet. Over time, that can mean 0.5 to 10 SOL sitting idle.

These apps scan your wallet, find zero ow low balance accounts and send a transaction to burn or close them. In return, you reclaim the rent. The key difference between tools is how flexible, transparent and cheap they are.

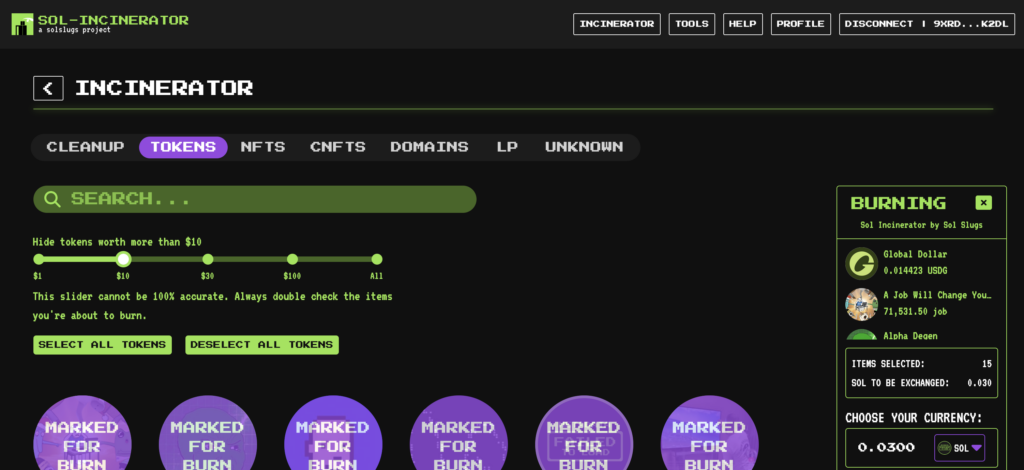

1. Sol Incinerator – Reliable Pioneer That Lacks Fee Transparency

Sol Incinerator deserves credit for being one of the first working claim tools on Solana. It set the standard early and, years later, it’s still online and functional – proof of strong technical foundations and trust from the community.

Sol Incinerator alternative page.

That said, the user experience hasn’t kept up with newer platforms. The interface feels a bit heavy and the font styling can make it tiring for long sessions. The real concern, however, is fee transparency: users don’t see an exact percentage before claiming, and final deductions often vary. There is also no option to select all tokens at once.

In crypto, transparency matters. For a service with this much history and recognition, clearer fee disclosure would go a long way.

Pros

- Longest-running and battle-tested tool

- Supports Ledger

- Stable performance under network load

Cons

- No upfront fee breakdown (fee unknown)

- Interface could use modern polish

- Limited clarity on transaction cost reporting

- Cannot select all tokens at once

Claim amount

For the testing wallet that we used, SOL Incinerator detected 1 empty account, and 13 ltokens. The total amount of rewards was 0.03 SOL

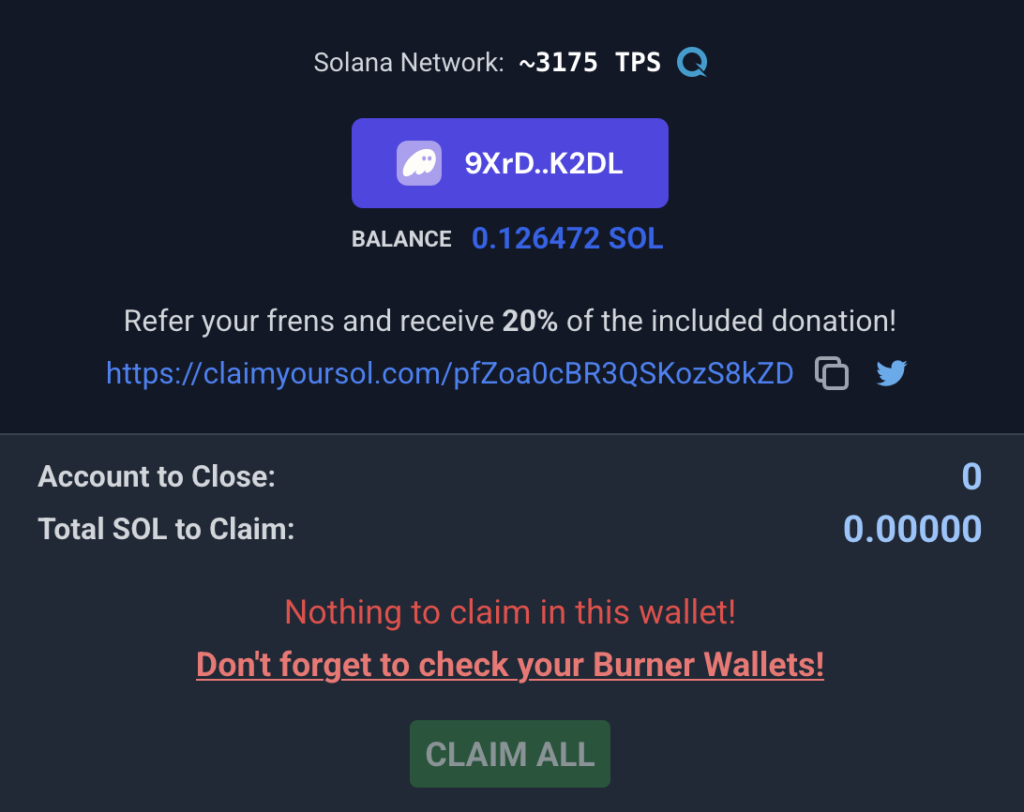

2. Claim Your SOL – High Fees, Basic Functionality

Claim Your SOL positions itself as beginner-friendly, but the numbers tell another story. The tool currently takes around 20% in service fees, which is far above market average. That means if you recover 1 SOL of rent, you only keep 0.8 SOL — the rest goes to the platform.

The interface is simple enough for small wallets, but lacks advanced features like burning small valued tokens for even more rewards.

Fee: ~20%, on every claim

Burn support: ❌

Claim Your SOL works, but if you actually want to claim most SOL back, this tool is simply too expensive for what it does and does not detect anything except empty tokens of a single kind. It wasn’t able to detect any empty token accounts and the reward was 0 SOL.

3. Unclaimed SOL – Transparent and Cheapest

This is where Unclaimed SOL dominates. It was built by Solana developers who understood how much rent was being lost to inefficient tools.

Pros:

- Lowest fee (only 5%)

- Clean User Interface for Simple Cleanup

- API integration used by bots like SOL Sniper and explorers like Solscan

Cons:

- Due to process simplification, some assets are grouped and not divided into categories which does not give clear overview of the asset type/category

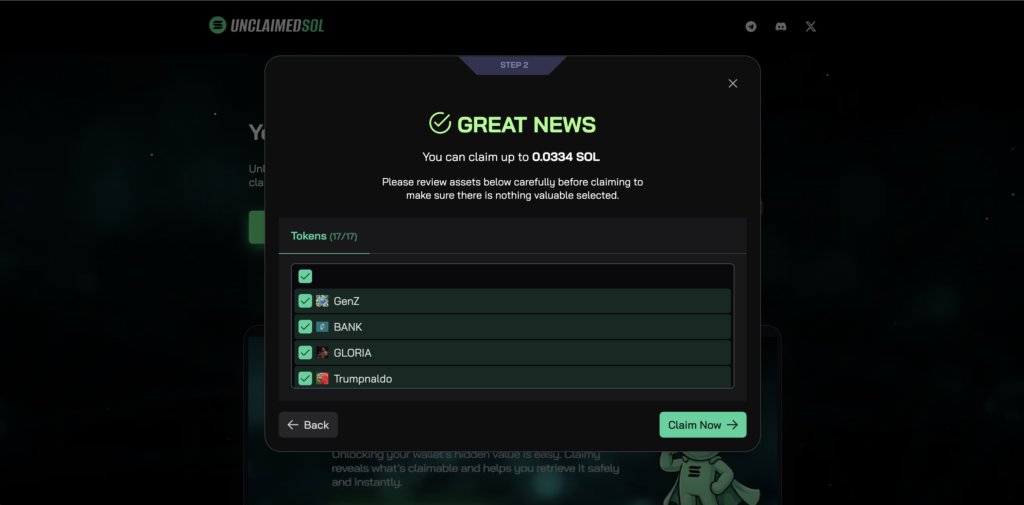

During the claim process, using the same wallet, Unclaimed SOL detected 17 assets and gave the total reward of the winning 0.0334 SOL

Feature-by-Feature Comparison

| Feature | Claim Your SOL | Sol Incinerator | Unclaimed SOL |

|---|---|---|---|

| Average Fee | 20% | Unknown | 5% |

| User Interface | Cluttered | Dated | Clean |

| Fee Transparency | Yes | No | Yes |

| Support | Fast | Fast | Fastest |

| Closes empty token accounts | Yes | Yes | Yes |

| Burns and closes low valued tokens | No | Yes | Yes |

| Integrations (API/SDK) | No | Yes | Yes |

| Looks for old defi programs and dust | No | No | Yes |

Real User Feedback

Traders across Twitter and Discord often share that Unclaimed SOL returns more than other tools. One user said:

“checked @unclaimed_sol on a whim – turns out I had some SOL just sitting there unclaimed. connect > sign > done. rewards were higher than other sites kinda wild how easy it was ” – view post by Kate Miller

Stories like that spread fast – and for good reason. Transparency builds trust.

Common Mistakes to Avoid

Even with the best reclaim tools, some users lose value because they:

- Run older wallet versions with failed close instructions

- Forget to approve all batch transactions

- Skip the preview step and misunderstand net returns

- Mix airdrop claim tools with rent-reclaim ones

Always review the estimate and run a small test first.

The Future of Claim Tools on Solana

Expect smarter “rent reclaim” systems ahead. As the ecosystem matures, tools like Unclaimed SOL are already exploring integration with wallets and DEX dashboards, turning claiming into a background process.

Meanwhile, older tools like SOL Incinerator, even though famous, may struggle to keep up with scale and newer demands. The ones who invest in automation and transparency will dominate – and those are the exact areas Unclaimed SOL leads in today.

Final Verdict – Who Lets You Claim Most SOL?

After testing all three, the results are clear:

| Rank | Tool | Reward | Strength | Best For |

|---|---|---|---|---|

| 🥇#1 | Unclaimed SOL | 0.0334 SOL | Lowest fees, clean process | Regular traders, devs |

| 🥈#2 | Sol Incinerator | 0.03 SOL | Famous but does not detect everything | Detailed burn logic |

| 🥉#3 | Claim Your SOL | 0 SOL | Fast but expensive | Casual users |

If your goal is to claim most SOL possible with minimal cost, UnclaimedSOL.com gives you the highest return rate, the lowest fees, and full transparency before you click “Claim.”

In short – less hype, more SOL back in your wallet.

FAQ

1. What does “claim most SOL” mean?

It refers to recovering the highest possible amount of rent locked in old token accounts after fees as well as low valued tokens.

2. Is all of the above tools safe?

Yes. They use on-chain smart instructions and signs only locally through your wallet.

3. Can I use these tools for free?

You pay only a small on-chain fee plus the tool’s service cut. Unclaimed SOL’s fee is currently around 5%, making it the cheapest option.